Profile

Our corporate strategy is based on three pillars:

LETTING

We hold real estate for long-term letting. In this way, we achieve stable and predictable rental income that generates steady corporate profits. This profit is the foundation for the distribution of attractive long-term dividends to our shareholders.

MODERNIZATION

We continuously invest in the quality of our properties and create modern office space that will remain attractive for our tenants in the long term. The continuous quality improvement increases the company value permanently.

GROWTH

Through selective acquisitions, we continuously expand our portfolio and generate steady corporate growth. The increase and optimization of our portfolio furthermore creates synergies in the management of our assets.

OURPORTFOLIO

alstria owns and manages a high-quality portfolio of office properties in the major German office centers. Due to our local presence and many years of experience, our team has in-depth market knowledge and develops detailed concepts for each individual building. Modernizing the properties is an substantial part of our integrated business model, on the basis of which we create consistent value.

OURFinancial Structure

We have a solid balance sheet, access to various sources of finance and our business model is very profitable. In recent years, we have built a strong reputation in the capital markets through transparent, reliable and continuous communication and positioned alstria as a solid investment target for investors.

OURTEAM

Committed, qualified and motivated employees are the basis of a successful company. We offer real estate experts, merchants, architects, engineers, designers and many other professions opportunities for their personal development. Our culture is entrepreneurial and collegial, with the aim of exceeding our own expectations.

ManagementBoard

The Management Board manages the operating business and is responsible for the strategic development of the company.

Chief Executive Officer (CEO)

Olivier Elamine

First appointed

2006

Term expires

2027

Personal information

Residence: Hamburg, Germany

Birthday: October 1972

Nationality: French

Career

Olivier Elamine is one of the founding members of alstria and became CEO of the Company in November 2006.

Prior to the founding of alstria, he was a Partner of NATIXIS Capital Partners Ltd. (NCP; formerly IXIS Capital Partners) from 2003 to 2006. Here he participated in more than EUR 6 billion of pan-European real estate transactions and led the acquisition of the Barmer and Stadt Hamburg portfolios.

In 2003, Olivier Elamine joined the Real Estate Investment Banking team at CDC IXIS as a Director and was one of the founding members of NATIXIS Capital Partners Ltd.

In 1998 Olivier Elamine joined Ernst & Young as a consultant in the real estate industry and from 2000 to 2003 he headed the Sales & Leaseback advisory team.

From 1996 to 1998, he worked at the French Embassy in Morocco.

Education

Olivier Elamine holds a civil engineering degree in Real Estate and Construction from the Ecole National des Travaux Publics de l’Etat, Lyon and a Master in Building and Construction Science from the Institut National des Sciences Apliquées, Lyon.

Other material activities

Member of the advisory board at Urban Campus Group SAS

as per December 31, 2024

Alexander Dexne

First appointed 2007

Term expires 2022

Personal information Residence: Hamburg, Germany Birthday: April 1965 Nationality: German

Career Alexander Dexne is CFO of alstria since June 2007. Prior to joining alstria, Alexander Dexne was CFO of MediGene AG and General Manager Finance at Olympus Optical (Europa).

Education Alexander Dexne holds a master´s degree (Diplom-Volkswirt) in Economics from the University of Göttingen and an MBA from Massey University in New Zealand.

as per January 01, 2020

SupervisoryBoard

The Supervisory Board appoints the Management Board and is the controlling committee of the Company. Members elected by the Annual General Meeting form the Supervisory Board, whose main tasks are to advise and monitor the Management Board.

Chairman of the SB

Managing Partner, Head of European Real Estate – Brookfield Asset Management

Vice-Chairman of the SB

Managing Partner at Brookfield Property Group

Managing Partner, Brookfield Asset Management

Brad Hyler

Chairman of the Supervisory Board of alstria office AG

Managing Partner, Head of European Real Estate – Brookfield Asset Management

Member since

2022

Term expires

2027

Personal information

Residence: London, Vereinigtes Königreich

Birthday: 1978

Nationality: US-Amerikanisch

Career

2001 to 2004: Project Manager & Financial Analyst in the Development Division at

The Keith Corporation, NC, USA

2004 to 2006: Associate with the New York Transactions & Corporate Services Group

at Jones Lang Lasalle, Inc., New York, USA

2006 to 2011: Vice President for Investments at O’Connor Capital Partners, New

York, USA

Since 2011: various positions at Brookfield Asset Management, London,

United Kingdom, most recently Managing Partner and Head of European Real Estate

Education

1996 to 1998: Virginia Tech University, Blacksburg VA- Pamplin College of Business, USA

1998 to 2000: B.A. Economics at the University of North Carolina in Chapel Hill, USA

Management Board mandates at listed companies in Germany and abroad:

n/a

Supervisory board mandates at listed companies in Germany and abroad and comparable functions (size, internationality and complexity):

Non-executive Director at Experimental Group SAS, United Kingdom

Non-executive Director at Center Parcs and affiliated companies, United Kingdom

Non-executive Director at Canary Wharf Group Investment Holdings PLC, United Kingdom

Other activities

n/a

as per Dezember 31, 2024

Jan Sucharda

Vice Chairman of alstria office AG

Managing Partner, Brookfield Property Group

Member since

2022

Term expires

2027

Personal information

Residence: Toronto, Canada

Birthday: 1960

Nationality: Canadian

Career

1983 to 1987: Project Manager of Toddglen Construction Ltd., Toronto, Canada

1988 to 1997: Vice President at Citibank Canada, Toronto, Canada

1997 to 2005: Senior Vice President for Asset Management of O&Y REIT/O&Y

Properties Inc.,Toronto, Kanada

Since 2005: different positions at Brookfield Asset Management, Toronto, Canada, last Managing Partner and Senior Advisor

Education

1983: Bachelor of Applied Science (Engineering) at Queen’s University, Kingston,

Canada

1988: Master of Business Administration from York University, Toronto, Canada

Management Board mandates at listed companies in Germany and abroad:

n/a

Supervisory board mandates at listed companies in Germany and abroad and comparable functions (size, internationality and complexity):

Director Brookfield India Real Estate Trust , Haryana, India

Director at Canary Wharf Group Investments Holdings plc, London, United Kingdom

Other activities

n/a

as per December 31, 2024

Richard Powers

Managing Partner, Brookfield Asset Management

Member since

2023

Term expires

2028

Personal information

Residence: London, United Kingdom

Birthday: 1963

Nationalities: British and US-American

September 1985 to October 1987 US Trust Corporation of NY

1987 to 1998: Head of International Real Estate at GE Capital, Vereinigtes Königreich

1999 to 2011: Partner at Goldman Sachs (Co-Head of European/U.S. Real Estate), Vereinigtes Königreich und USA

2011 to 2018: Managing Member at Grand Street Investments, USA

2018 to 2022: Managing Partner at O-Zone Partners, USA

Since 2022: Managing Partner at Brookfield Asset Management, London, Vereinigtes Königreich

Education

Bachelor of Arts, Yale University, USA

Management Board mandates at listed companies in Germany and abroad:

n/a

Supervisory board mandates at listed companies in Germany and abroad and comparable functions (size, internationality and complexity):

n/a

Other activities

n/a

as per December 31, 2024

Chair of the Audit Committee of the SB

Chief Financial Officer, Canary Wharf Group

Becky Worthington

Chief Financial Officer, Canary Wharf Group, London, United Kingdom

Member since

2022

Term expires

2028

Personal information

Residence: Berkshire, Vereinigtes Königreich

Birthday: 1971

Nationality: Britisch

Career

1994 to 1997: Training as a chartered accountant at PriceWaterhouseCoopers (Coopers

& Lybrand), United Kingdom

1997 to 1998: Financial Controller at Britton Group PLC, United Kingdom

1998 to 2012: various positions at Quintin Estates and Development Plc, most recently

Deputy Chief Executive, United Kingdom

2012 to 2015: Founder and Chief Executive Officer at Lodestone Capital Partners LLP;

United Kingdom

2015 to 2018: Group Chief Financial Officer at Countryside Properties PLC, United Kingdom

Kingdom

2018 to 2019: Group Chief Operating Officer at Countryside Properties PLC, United Kingdom

Kingdom

2019 to 2021: Chief Financial Officer at IQ Student Accommodation, United Kingdom

Since 2021: Chief Financial Officer at Canary Wharf Group, United Kingdom

Education

1990 to 1993: Joint Honors degree Economics and Philosophy, University of Nottingham,

United Kingdom

Management Board mandates at listed companies in Germany and abroad:

n/a

Supervisory board mandates at listed companies in Germany and abroad and comparable functions (size, internationality and complexity):

n/a

Other activities

n/a

as per December 31, 2024

| COMMITTEE | MEMBERS |

|---|---|

| Audit Committee | Becky Worthington (chair) Brad Hyler Richard Powers Jan Sucharda |

| AUSSCHUSS | MITGLIEDER | |

|---|---|---|

| Audit Committee |

Becky Worthington (chair) Brad Hyler Dr. Frank Pörschke | |

| Nomination & Remuneration Committee |

Brad Hyler (chair) Elisabeth Stheeman Jan Sucharda | |

Profile for the Supervisory Board

The Supervisory Board has issued a profile for its composition:

CorporateGovernance

The core values of integrity, respect, performance, accountability and sustainability are deeply rooted in our corporate culture. Responsible, transparent management and control of the company guarantee the highest standards. Ethical conduct is the indispensable basis for the trust that our investors, tenants, business partners, employees and the public place in our company.

Articles of Association

The Articles of Association regulate the corporate law basis of our company.

Rules of Procedure for the Supervisory Board

The Supervisory Board has issued Rules of Procedure.

Statement of Compliance

Once a year, the Management Board and the Supervisory Board of alstria declare that the recommendation of the GCGC were compiled with or which recommendations were not and are not being applied, and why not.

Februar 10, 2025

February 27, 2024

March 15, 2023

April 24, 2022

April 02, 2022

March 2021

December 2020

December 2019

February 2019

February 2018

February 2017

Corporate GovernanceStatement

The corporate governance statement contains all relevant information on corporate governance practices and a description of the working methods of the Management Board and Supervisory Board and their committees.

February 2025

February 2024

February 2023

Februar 2022

February 2021

Corporate Governance Statement

February 2019

Corporate Governance Statement

February 2018

Corporate Governance Statement

March 2017

Remuneration

The management board remuneration system is performance-based and aimed at promoting sustainable corporate development. The supervisory board revised the remuneration system for the members of the management board effective January 1, 2022 and submitted it to the annual general meeting on June 10, 2022 for approval under agenda item 9. The annual general meeting approved the remuneration system for members of the management board 2022 with a majority of 99.55%.

Of the supervisory board members, only the chair of the audit committee of the supervisory board receives a fixed remuneration that is published on an individualized bases in the financial report. The remuneration is performance-unrelated. All supervisory board members are reimbursed for their expenses. Attendance fees are not paid. The structure and amount of remuneration of the Supervisory Board was confirmed by the annual general meeting on May 4, 2023

under agenda item 10 with 96.6% approval.

DirectorsDealings

The directors’ dealings include the management’s own dealings in shares or debt securities of the company, which have been notified to the company and to the Federal Agency for Financial Services Supervision (BaFin).

Overview ot the total number of company’s shares held by members of the Management Board and Supervisory Board.

As of January 16, 2025

| OWNER | NUMBER OF SHARES |

|---|---|

| Olivier Elamine | 70,427 |

| Brad Hyler | 0 |

| Jan Sucharda | 0 |

| Richard Powers | 0 |

| Rebecca Worthington | 0 |

| Inhaber | Anzahl Aktien | |

|---|---|---|

| Olivier Elamine | 70427 | |

| Alexander Dexne | 57653 | |

| Dr. Frank Pörschke | 0 | |

| Elisabeth Stheeman | 0 | |

OnSite

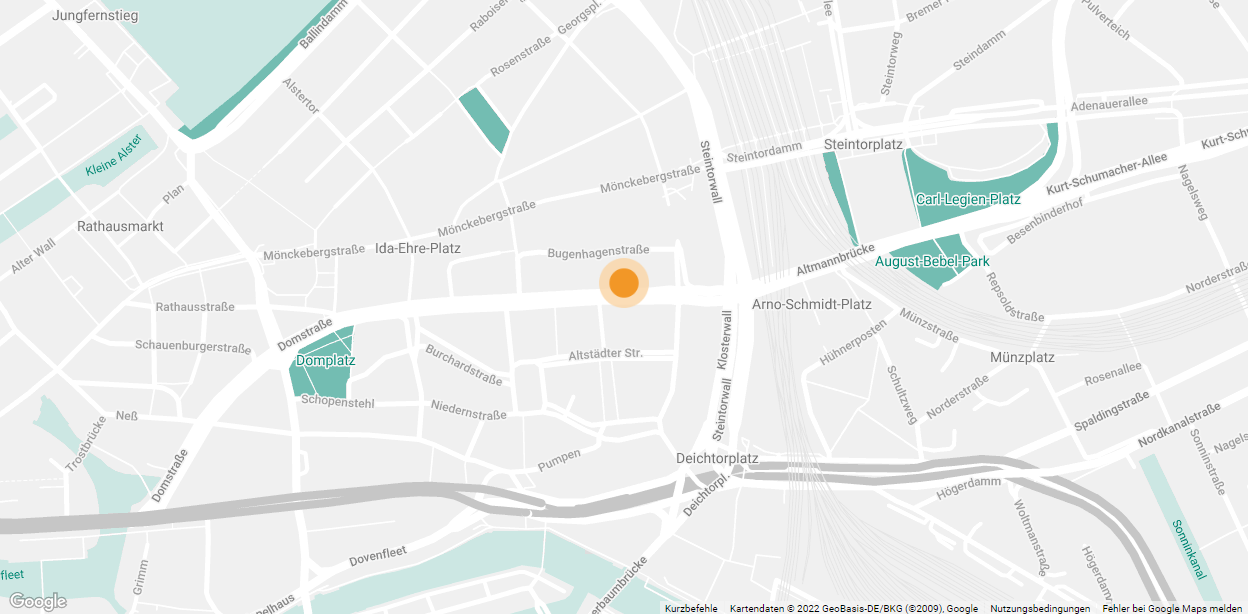

Hamburg

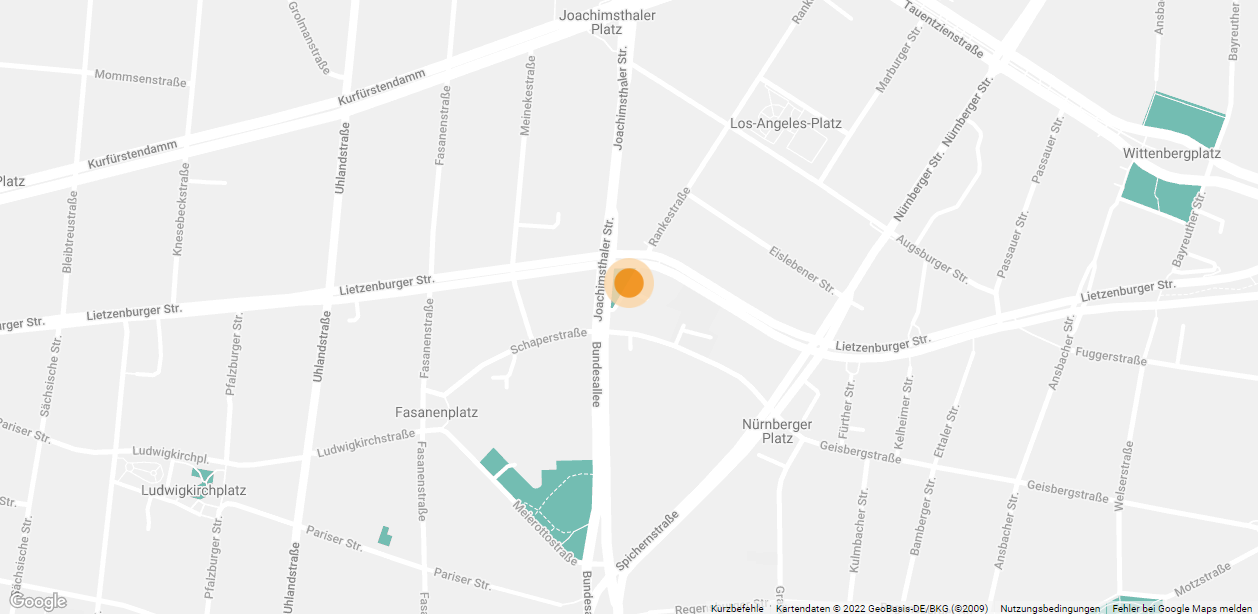

Berlin

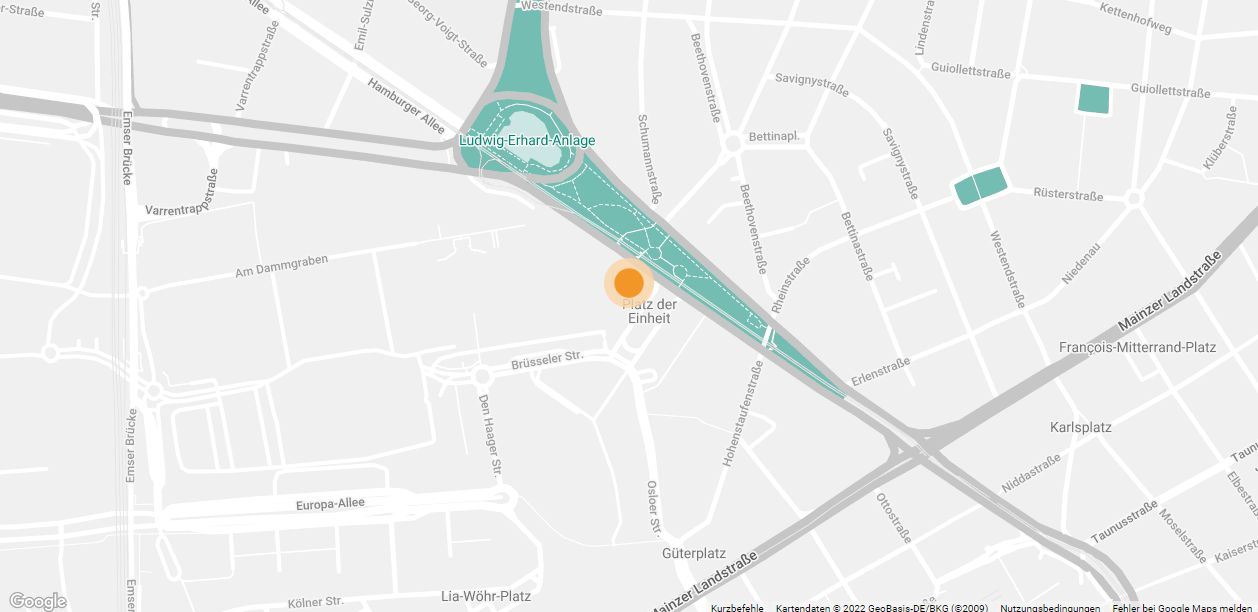

Frankfurt

Düsseldorf

Stuttgart

Headquarters

Hamburg Steinstraße 7 20095 Hamburg T +49(0)40 – 22 63 41 300 F +49(0)40 – 22 63 41 310 Directions

Headquarters

Berlin Rankestraße 17 10789 berlin T +49(0)30 – 896 779 500 F +49(0)30 – 896 779 501 Directions

Headquarters

Frankfurt Platz der Einheit 1 60327 Frankfurt am Main T +49(0)69 – 153 256 740 F +49(0)69 – 153 256 745 Directions

Headquarters

Düsseldorf Elisabethstraße 11 40217 Düsseldorf T +49(0)211 – 301 216 600 F +49(0)211 – 301 216 615 Directions

Headquarters

Stuttgart

Reuchlinstraße 27

70176 Stuttgart

T +49(0)711 – 33 50 01 50

F +49(0)711 – 33 50 01 55

Awards

We are proud of our performance and are pleased about the recognition of well-known organizations. Below you will find a selection of our awards.

ZIA

Award

for alstrias

CO2-Concept 2018

S&P Global

Sustainability

Yearbook

Member 2021

EPRA

BPR GOLD

Award

for alstrias

Reporting